Bhutan Tourism Update H1 2025: Growth Trends, Drukair Developments, and Gelephu City Progress

This mid-year report explores Bhutan’s tourism performance in H1 2025, spotlighting strong growth trends, Drukair’s ambitious expansion plans, and a wave of new hospitality developments. It also offers an overview of the visionary Gelephu Mindfulness City project.

This report provides a comprehensive update on Bhutan's tourism sector for the first half of 2025, highlighting significant growth, key developments in aviation and hospitality, and the ambitious vision for Gelephu Mindfulness City. Prepared by Druk Asia Publishing, this analysis covers tourist arrival data, Drukair's expansion plans, ongoing hospitality projects, and the progress of the Gelephu International Airport.

Tourism Growth & Market Trends (2023–2025)

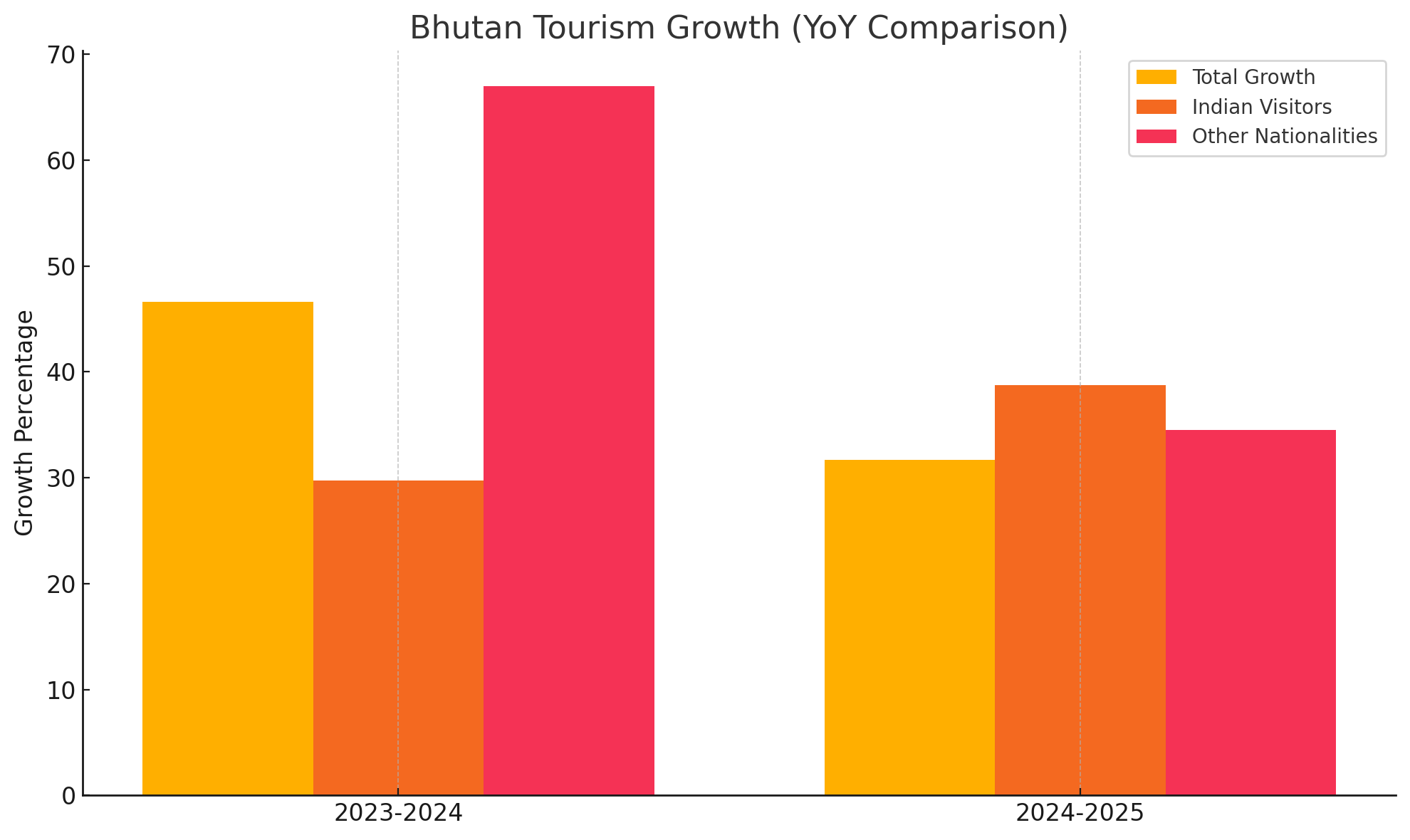

Bhutan’s tourism industry has seen sustained double-digit year-on-year growth. From January to June 2024, the country welcomed 46.64% more visitors compared to the same period in 2023. This momentum continued into 2025, with arrivals up another 31.66% versus 2024.

Between January and June 2025, Bhutan recorded a +31.66% increase in tourist arrivals compared to the same period in 2024, which itself had seen a whopping +46.64% growth over 2023. This consistent upward trend signals global confidence in Bhutan as a safe, enriching, and must-visit destination.

Segmenting this surge:

-

Indian tourists: +29.76% (2023→2024), +38.72% (2024→2025)

-

Other nationalities: +67.02% (2023→2024), +34.49% (2024→2025)

55,000 Indians entered via the Phuentsholing land border, and 10,000 enter by air through Paro Airport, highlighting points of entry as strategic assets for market-specific growth.

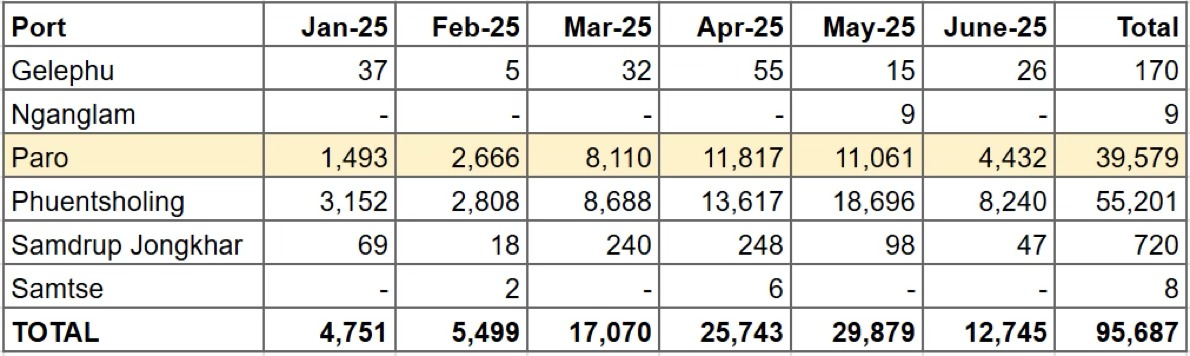

Breakdown of 2025 Monthly Tourist Arrivals by Port of Entry (Source: https://bhutan.travel/travel-trade)

Year-on-Year Tourist Arrivals Growth by Market Segment (2023-2025) (Source: https://bhutan.travel/travel-trade)

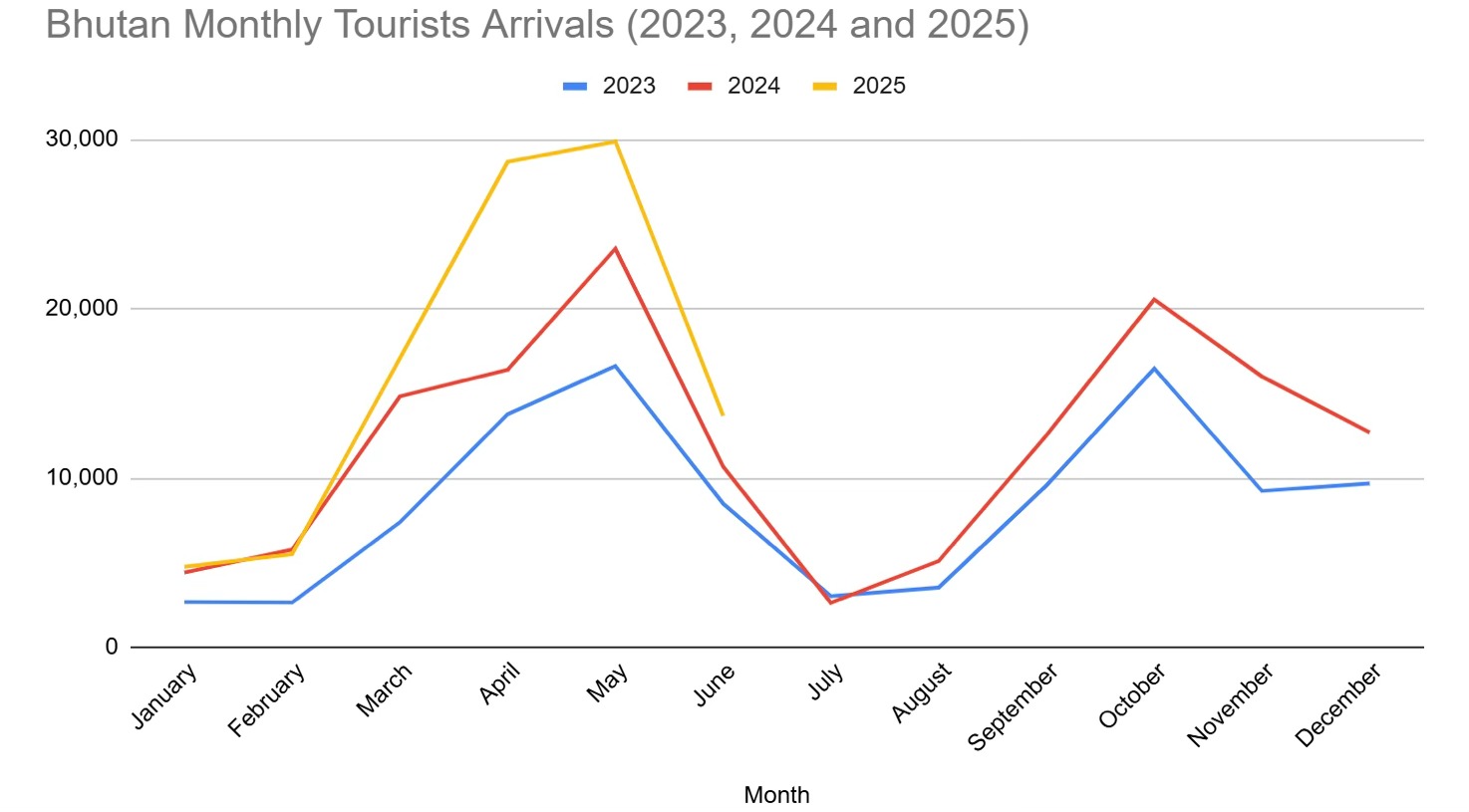

Bhutan Monthly Tourists Arrivals (2023, 2024 and 2025) (Source: https://bhutan.travel/travel-trade)

Total Tourist Arrivals in Bhutan by Month (2023, 2024, 2025) (Source: https://bhutan.travel/travel-trade)

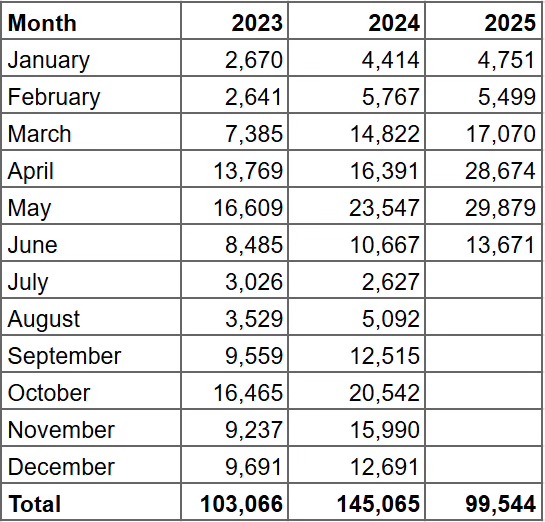

Top 10 Source Markets for Bhutan in 2024

Top Ten Source Markets for Visitors to Bhutan in 2024 (Source: https://bhutan.travel/travel-trade)

The top ten source markets for visitors to Bhutan in 2024 show a wide and diverse group of travelers. Indian tourists are the largest group, with 94,280 visitors, due to close geographic, cultural, and policy connections between Bhutan and India. Following India, the United States, China, and Singapore are important markets, showing Bhutan’s growing popularity in North America and Asia.

Visitors from the UK and Germany are also significant, attracted by Bhutan’s unique mix of culture, nature, and wellness. Increasing numbers from Malaysia, Australia, Taiwan, and Canada show that Bhutan is becoming known worldwide. This variety of visitors highlights the need for tourism strategies that meet the needs of both nearby neighbors and long-distance travelers, keeping Bhutan's reputation as a special, wellness-focused destination that values sustainable and exclusive tourism.

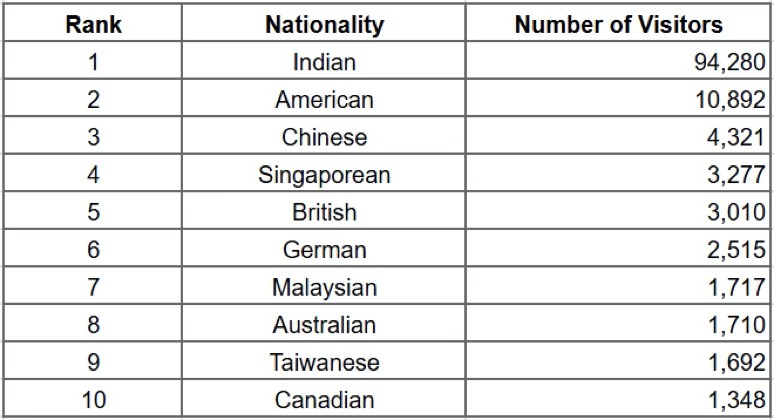

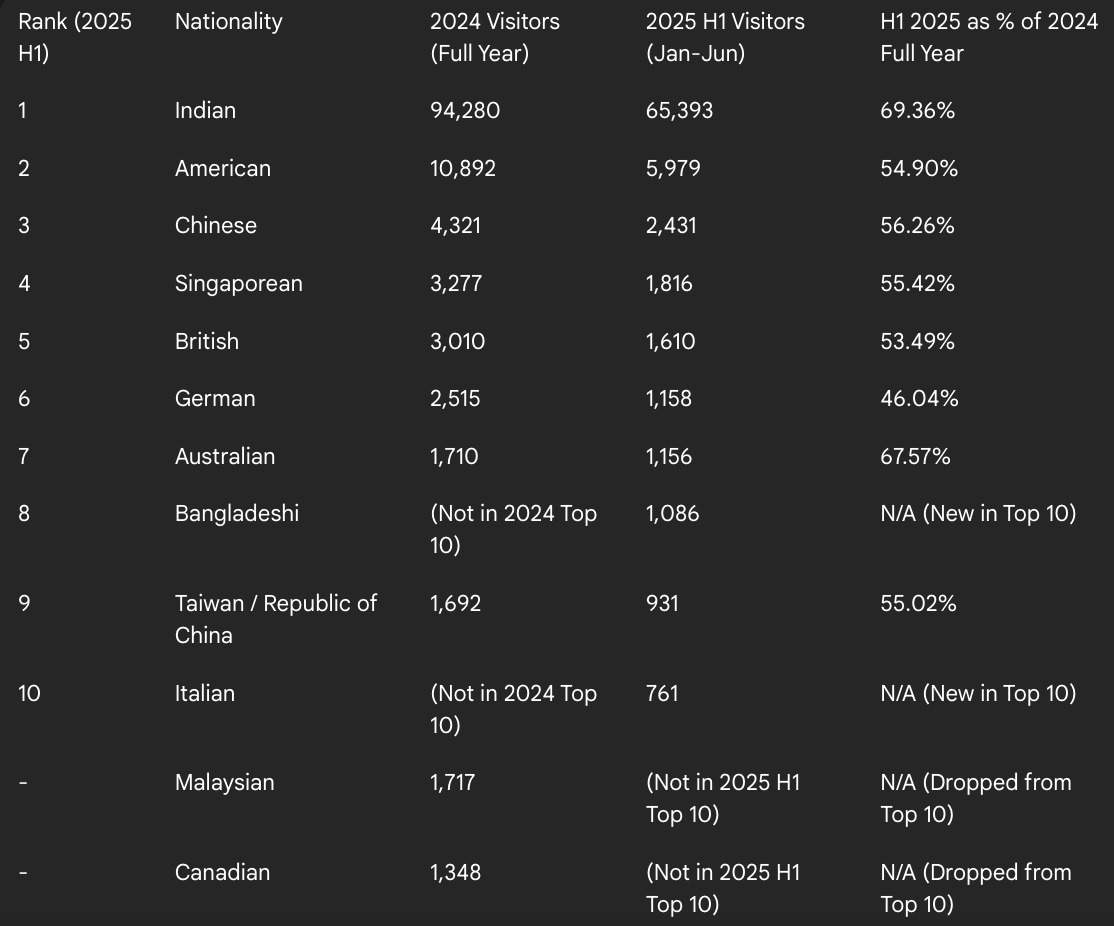

Top 10 Source Markets for Bhutan in 2025

(Source: https://bhutan.travel/travel-trade)

For the first half of 2025, the top source markets for visitors to Bhutan continue to reflect both strong regional ties and growing international interest. Indian tourists lead prominently with 65,393 arrivals, maintaining their dominant position due to geographic proximity and cultural affinity. Americans follow behind with 5,979 visitors, highlighting continued demand from North America. Chinese visitors number 2,431, showing steady interest alongside growing numbers from Singapore (1,816), the UK (1,610), Germany (1,158), and Australia (1,156). Other notable contributors include Bangladesh (1,086), the Republic of China/Taiwan (931), and Italy (761), demonstrating Bhutan’s expanding appeal across Asia and Europe.

Top Source Markets: 2024 (Full Year) vs. 2025 (January-June)

(Source: https://bhutan.travel/travel-trade)

Key Observations on Growth Rates:

- Indian Market: India continues to be the dominant source market. With 65,393 visitors in the first half of 2025, they have already reached nearly 70% of their total 2024 visitor numbers. This indicates strong continued growth from India.

- Consistent Top Performers (American, Chinese, Singaporean, British, Taiwan/Republic of China): These nationalities, including Taiwan/Republic of China (which saw 931 visitors in H1 2025, representing 55.02% of its 2024 total), have already achieved over half of their previous year's total within six months. This suggests a healthy and consistent flow of tourists from these countries.

- Emerging Markets in Top 10 (Bangladeshi, Italian): Bangladesh and Italy were not in the top 10 for the full year 2024 but have entered the top 10 for H1 2025. This indicates growing interest and potentially targeted marketing efforts in these regions.

-

Bangladesh recorded 1,086 visitors in H1 2025.

-

Italy recorded 761 visitors in H1 2025.

-

- Markets that Dropped from Top 10 (Malaysia, Canada): Malaysia and Canada were in the top 10 in 2024 but are not in the top 10 for H1 2025. This doesn't necessarily mean a decline in absolute numbers for the full year, but it indicates that other markets have grown at a faster pace in the first half of 2025 to overtake them.

- German Market: While still in the top 10, Germany's H1 2025 visitors represent a smaller proportion of their full 2024 numbers (46.04%) compared to other established markets, which might indicate slower relative growth for the first half of the year.

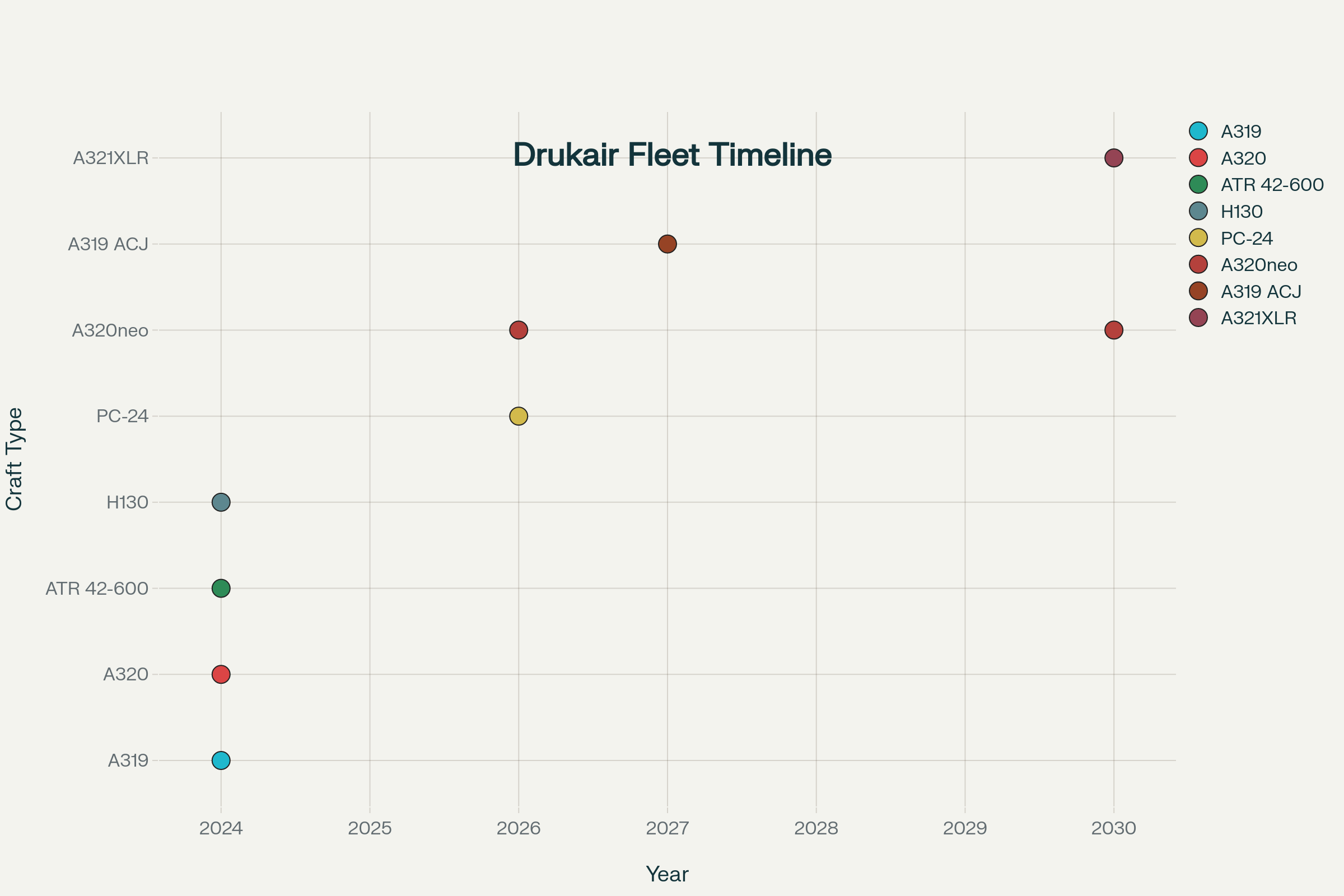

Drukair: Fleet Expansion and Network Growth

To cope with booming arrivals and the demands of Gelephu’s new international airport, national flag carrier Drukair has embarked on an ambitious fleet upgrade and route expansion:

-

New Aircraft by 2025–2026: Delivery of the Pilatus PC-24 (Sep 2025) for VIP/charter flights an d the conversion of Airbus A319 to an ACJ (July 2026) for business and premium routes. Additionally, Drukair will lease a new Airbus A320neo from SMBC Aviation Capital for 12 years, with delivery expected in December 2026.

-

Network Boost (2030+): Introduction of 3 A320neo and 2 A321XLR aircraft, targeting longer-haul destinations in Europe, Southeast Asia, and Australia.

-

Route Enhancement: Paro–Singapore flight frequency will triple in 2026, improving connectivity and supporting high-value, low-impact tourism.

These efforts align with plans for Gelephu Mindfulness City’s global ambitions and Bhutan’s evolving role as a Himalayan gateway.

Drukair Fleet Timeline

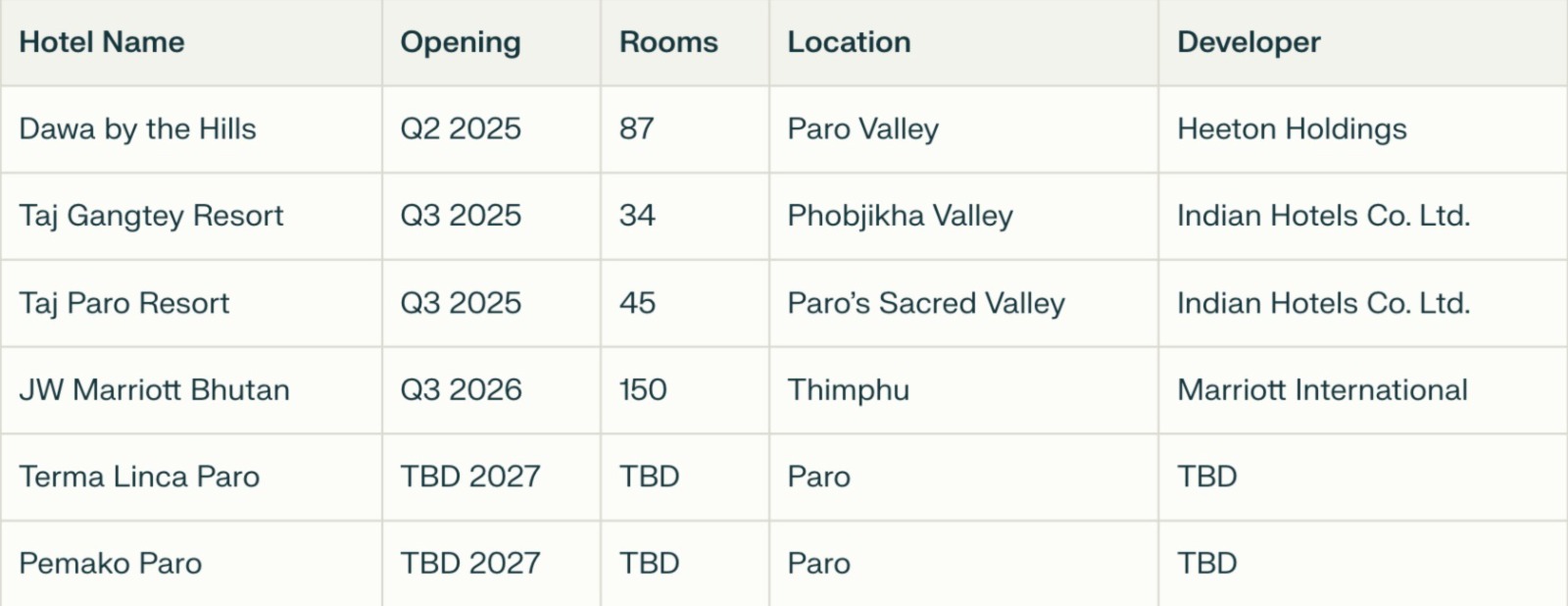

Hospitality Projects Underway

Bhutan's hospitality sector is seeing significant investment with several new hotels slated to open.

This wave of branded, high-end openings underscores Bhutan’s positioning as a premium, sustainable tourism destination and caters to both leisure and wellness markets.

In recent years, more travellers have been seeking destinations that offer not just relaxation, but also opportunities for personal renewal, wellness, and luxury retreat. Bhutan has emerged as a premier choice for these discerning visitors, thanks to its pristine natural environment, deep-rooted spiritual traditions, and an expanding array of high-end resorts.

Whether it’s meditation retreats set amidst breathtaking Himalayan landscapes, indulgent spa experiences, or the attentive hospitality of internationally renowned hotels, Bhutan seamlessly blends wellness and luxury. The country’s unique “high-value, low-volume” tourism philosophy ensures that guests enjoy exclusive, personalized journeys while preserving Bhutan’s cultural and environmental integrity—making it an ideal destination for those seeking both rejuvenation and refinement.

In line with these growing travel trends, Druk Asia has introduced The Bhutan Insider Experience with James Low—a luxury tour package designed for those who wish to uncover Bhutan beyond the ordinary, led by someone who knows the Kingdom inside out.

Gelephu Mindfulness City & International Airport

Bhutan’s most ambitious future-facing project is the creation of Gelephu Mindfulness City (GMC), a sustainable Special Administrative Region on the southern plains. The city’s anchor is the Gelephu International Airport, designed to handle over 1.3 million passengers per year (expandable to 5.5 million+), with a terminal reflecting Bhutan’s forest ecosystems and strict green energy standards.

Airport Development Timeline

Timeline |

Progress |

| 8th June 2025 | Groundbreaking ceremony |

| April 2026 | Main construction of runway and terminal |

| July 2026 | Installation of airport systems |

| July 2028 | Aerodrome Certification Begins |

| March 2029 | Testing and commissioning |

| July 2029 | ORAT (Operational Readiness & Airport Transfer) Starts |

| December 2029 | Grand inauguration of Gelephu International Airport |

The event brought together more than a thousand Desuup and Gyalsup volunteers, who embodied the Bhutanese tradition of zhabtog, or voluntary community service, exemplifying national unity and purpose. The day began with sacred prayers led by the Dorji Lopen to bless the land and the undertaking. This groundbreaking was more than the start of a construction project—it was a declaration of Bhutan's commitment to sustainable progress and opportunity for future generations, setting the stage for a project deeply rooted in cultural values, environmental stewardship, and national aspiration.

Airport Details:

Location: 4 sq. km across Paitha River, Sarpang Dzongkhag

Runway: 3,000-meter, Code 4E (capable of handling Airbus A321/B737)

Passenger Capacity: Initially 1.3 million per year, expandable to over 5.5 million

Terminal Design: Inspired by Bhutan’s forest ecosystems

Sustainability: Incorporates green energy, passive ventilation, and river flow conservation

The airport is expected to transform southern Bhutan into a pan-regional economic and tourism nexus, boosting both inbound and outbound connectivity.

Find out all about the Gelephu International Airport.

Investment Insight: Gelephu Mindfulness City Nation Building Bond (GNBB)

Recognizing the magnitude of these projects, Bhutan launched the GNBB—a 10-year, 10% annual coupon, tax-exempt bond. The response was exceptional:

-

Nu. 3.347 billion invested (vs. Nu. 2 billion target), with 35,403 Bhutanese investors

-

Over 18,000 first-time investors joined via Bhutan’s National Digital Identity platform

-

Funds directly support Gelephu International Airport construction, symbolizing national confidence in Bhutan’s infrastructure vision

Conclusion: Bhutan’s Strategic Outlook

Bhutan’s unique blend of sustainable tourism, cutting-edge infrastructure, and mindful urban development offers a model for regional prosperity. The alignment of policy, investment, and global ambition promises a new era for Bhutanese tourism, anchored by quality, innovation, and resilience.