Removing Bhutan’s import taxes on sanitary products is crucial for period equity

What might elimination of the 30 percent import tax on sanitary supplies mean for Bhutanese citizens?

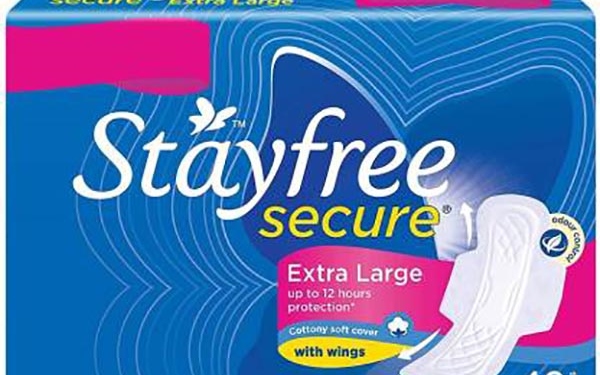

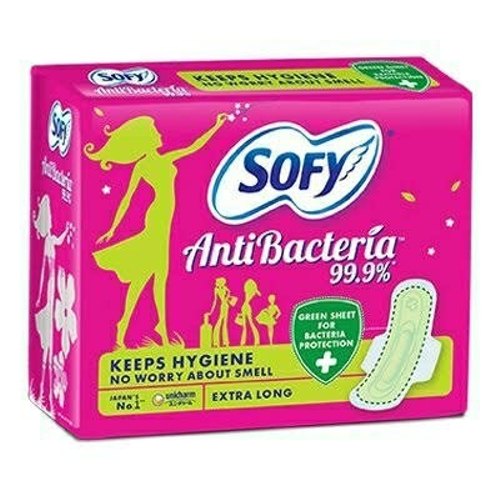

Sanitary supplies for menstruation are a necessity, not a luxury. Yet, period poverty remains a grim reality for the 500 million girls, women, and transgender individuals worldwide who lack sufficient access to menstrual products. Many countries—including Scotland, Bangladesh, New Zealand, and South Africa—are taking important steps toward period equity by eliminating or reducing taxes on menstrual products to improve access and lower prices.

Bhutan is setting out on a similar path.

On May 28, heeding a call to address menstrual health management (MHM) from Her Royal Highness Ashi Eeuphelma Choden Wangchuck—Patron of Red Dot Campaign— Prime Minister announced plans “to propose removing the 30 percent import duty imposed on sanitary products this Parliament session.” He stated this was a “small, yet significant gesture to enhance availability and accessibility of basic sanitary items.”

This is a commendable proposal that will improve the fundamental rights and wellbeing of Bhutan’s female and transgender population. Here’s why.

Currently, Bhutan imposes a 5 percent sales tax on sanitary pads imported from India, and an additional 30 percent tax on sanitary pads and tampons from other countries. Ending the 30 percent import tax would, therefore, only impact supplies from countries besides India. Although the Department of Revenue and Customs notes that this could reduce government revenues by an annual average of Nu. 210,674, end-users of menstrual products could see substantial long-term benefits in the form of lower prices and improved access.

Removing import taxes on sanitary products has been shown to have a greater effect on consumer prices in countries heavily reliant on foreign products. This is the case for Bhutan, which imports almost 100% of its sanitary products. Therefore, tax removal would mean supplies from other countries such as Thailand could become more competitive in Bhutan, improving consumer choices, providing access to more sanitary product alternatives, and potentially reducing prices.

Advocates in Bangladesh, for example, have projected that tax exemptions on sanitary products could reduce retail prices by 40-50%. Allowing the domestic market for sanitary products to grow could also improve supply chains and distribution networks, ultimately boosting access to various menstrual products throughout the country.

Tax removal and the potential growth of the sanitary product market in Bhutan might lead to numerous other non-tax-related benefits for Bhutanese society.

First, because Bhutanese citizens often rely on makeshift alternatives for sanitary products like rags in the absence of affordable sanitary alternatives, the proliferation of more, potentially cheaper products could reduce health risks. In other words, access and affordability are key to improving menstrual health and hygiene, especially for low-income consumers.

Second, as distribution improves and the market for sanitary products grows, easier access could reduce absentee rates among young girls. For many young girls, easily available and affordable products in the markets can make the difference between going to school or not during their menstruation cycles.

Third, removal of the import tax will give visibility to menstruation management issues and advance conversations about basic health rights. To achieve period equity, much depends on dispelling taboos, increasing knowledge, and overturning gender norms. From an economic standpoint, this means removing tax barriers to the proliferation of menstrual products and allowing consumer choices to grow.

Overall, ensuring menstruation supplies advances women’s rights. Removing the import tax is a step towards ending period poverty and guaranteeing justice for the marginalized in Bhutan. But tax changes alone are not a silver bullet. The potential removal of the import duty tax should be part of a wider government initiative to end period poverty. Mutually reinforcing factors such as knowledge about menstruation, appropriate WASH facilities, and addressing taboos and stigmas should also be considered.

Fortunately, Bhutanese policymakers are taking a multidimensional approach to these issues. For example, one of the first projects under an agreement between Respect, Educate, Nurture and Empower Women, and the Ministry of Education is to distribute reusable sanitary napkins to schools and nunneries.

Moreover, a recent report by UNICEF and WaterAid noted that access to soap and handwashing stations had increased 77% in 2020 and changing rooms are increasingly available in schools. The same report also mentioned the upcoming dissemination of A Knowledge Book on Menstrual Health and Hygiene in schools and nunneries.

Therefore, removing the import tax is part and parcel of the government’s existing approach to addressing sanitary and menstrual health issues.

Menstruation is not a choice. When over 50% of the population must buy menstrual products to survive and thrive, taxing those products is essentially discriminatory. In this sense, the regressive import tax represents a clear economic bias favouring those who do not menstruate. By removing it, the government would be championing the right of Bhutanese citizens to menstruate safely, with dignity and comfort.

Bhutan’s recent efforts have been nothing short of progressive. But in the insightful words of HRH Ashi Eeuphelma Choden Wangchuck, “[W]e have made good progress in ensuring access and availability of menstrual hygiene products and in destigmatizing the taboos around menstruation. However, much needs to be done.”

Written by Mende Thuji Yangden and Sam Reynolds